Interest rates are a critical factor in the financial landscape, influencing everything from mortgages and personal loans to credit cards. However, the perplexing reality is that interest rates can vary significantly across different financial products and institutions.

In this article, we’ll delve into the intricacies of why interest rates vary so much, shedding light on the factors that contribute to these fluctuations. Along the way, we’ll also explore the role of the TopKredit team in helping borrowers navigate this complex terrain.

Understanding the Basics: What Are Interest Rates?

Before we explore the reasons for the wide range of interest rates, let’s establish a fundamental understanding of what interest rates are. In essence, an interest rate is the cost of borrowing money or the return on investment for lending money. It is typically expressed as a percentage and can be fixed or variable.

Factors Influencing Interest Rates

1. Economic Conditions

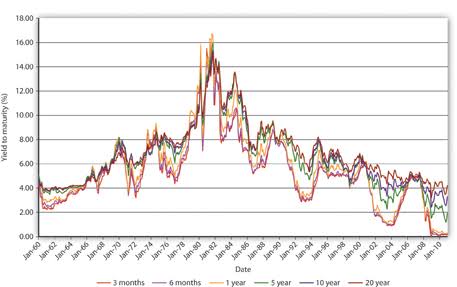

These are highly sensitive to economic conditions. In periods of economic growth, central banks might raise interest rates to curb inflation. Conversely, during economic downturns, central banks may lower interest rates to stimulate borrowing and spending. The overall economic health of a country plays a significant role in determining the direction of interest rates.

2. Central Bank Policies

Central banks, such as the Federal Reserve in the United States or the European Central Bank in the Eurozone, have a profound impact on interest rates. Through monetary policy, central banks adjust interest rates to achieve specific economic objectives, such as maintaining price stability and supporting employment. Changes in central bank policies can trigger fluctuations in interest rates across the financial system.

3. Inflation Expectations

Inflation erodes the purchasing power of money over time. Lenders factor in inflation expectations when determining interest rates to ensure they receive a real return on their loans. When inflation expectations are high, lenders may demand higher interest rates to compensate for the anticipated loss of purchasing power.

4. Credit Risk

Individual borrowers and businesses pose varying levels of credit risk. Lenders assess this risk when determining the interest rates they offer. Borrowers with excellent credit histories are generally deemed lower risk and may qualify for lower interest rates. Conversely, those with a history of late payments or financial challenges may face higher interest rates to offset the perceived risk.

5. Loan Term and Type

The term of the loan and its type can also influence it. Short-term loans often have lower interest rates than long-term loans due to the reduced uncertainty for lenders over a shorter period. Additionally, secured loans, backed by collateral, tend to have lower interest rates compared to unsecured loans, which carry higher risk for lenders.

6. Competition Among Lenders

Competition in the financial market is a significant driver of interest rate variations. When numerous lenders are vying for borrowers, they may adjust their interest rates to attract business. This competition can lead to more favorable terms for borrowers, including lower interest rates and additional perks.

7. Global Economic Factors

In an interconnected global economy, international events and economic conditions can influence interest rates. Factors such as geopolitical tensions, trade agreements, and global financial crises can create uncertainties that reverberate through financial markets, impacting interest rates on a global scale.

The Role of the TopKredit Team

Amidst the complexity of interest rate variations, borrowers often find themselves seeking guidance to navigate the intricacies of the lending landscape. This is where the TopKredit team comes into play.

1. Financial Expertise

The TopKredit team comprises financial experts who possess a deep understanding of the lending industry. Leveraging their expertise, they assist borrowers in comprehending the factors influencing interest rates and guide them toward the most suitable financial solutions.

2. Tailored Financial Solutions

Recognizing that each borrower is unique, the TopKredit team works to provide tailored financial solutions. By considering individual financial situations, credit histories, and objectives, they assist borrowers in securing loans with favorable interest rates and terms.

3. Navigating Market Dynamics

The financial markets are dynamic and subject to constant changes. The TopKredit team stays abreast of market trends, central bank policies, and economic developments to provide borrowers with up-to-date information. This enables borrowers to make informed decisions based on the current financial landscape.

4. Streamlined Application Process

Navigating the loan application process can be daunting, especially for those unfamiliar with the intricacies of lending. The TopKredit team simplifies the process, guiding borrowers through the application steps and ensuring that all necessary documentation is in order. This streamlined approach minimizes stress and expedites the approval process.

Conclusion

In conclusion, the wide variations in interest rates are a result of a multitude of factors, including economic conditions, central bank policies, credit risk, and global economic influences.

Understanding these factors is crucial for borrowers seeking favourable terms on loans. The TopKredit team serves as a valuable ally in this journey, offering financial expertise, tailored solutions, and assistance in navigating the complexities of the lending landscape.

By partnering with experts like the TopKredit team, borrowers can make informed decisions and secure loans that align with their financial goals.