In recent years, the financial landscape in the Philippines has witnessed a significant transformation, driven by the emergence of online lending platforms.

Among these, Juanhand has emerged as a notable player, providing accessible and legitimate online loans to Filipinos.

In this comprehensive guide, we delve into the intricacies of Juanhand, exploring its origins, legality, advantages, loan requirements, conditions, application process, and repayment methods.

Origins and Legality of Juanhand

Juanhand: Bridging Financial Gaps Since 2019

Juanhand is a product of WeFund Lending Corp., a subsidiary of the FinVolution Group—a prominent Chinese fintech company. Introduced in 2019, Juanhand has swiftly positioned itself as a reliable online lending platform in the Philippines.

Unlike some intermediaries, Juanhand acts as a direct lender, offering a seamless and fully automated mobile loan application available 24/7.

Legal Assurance and Compliance

Addressing concerns about its legality, Juanhand is registered with the Securities and Exchange Commission (SEC) under number CS201825672 and holds certificate of authority number 2844.

The SEC website provides a list of registered online lending platforms, affirming Juanhand’s commitment to operating within the bounds of Philippine law. With its headquarters in Taguig, Metro Manila, Juanhand’s physical presence adds to its credibility and adherence to regulatory standards.

Advantages of Juanhand Loans

1. Instant Approval and Same-Day Withdrawals

One of Juanhand’s standout features is its commitment to providing swift responses. Through the app, users can attain instant approval and withdraw funds on the same day.

The automated processes, devoid of human intervention, facilitate quick assessments of a client’s solvency, ensuring a prompt and efficient experience.

2. Loan Calculator for Informed Borrowing

Juanhand’s website offers a user-friendly loan calculator. This tool enables individuals to accurately compute monthly payments for specified loan amounts and terms.

The calculator also estimates the borrowing cost, empowering users to make informed decisions aligned with their financial capabilities.

Juanhand Loan Requirements

1. Accessibility for the Unbanked Population

Juanhand prioritizes financial inclusion, recognizing that a significant portion of the Filipino population lacks traditional banking access.

The platform extends its services to any Filipino adult with a GSave account and an internet-enabled mobile phone, fostering economic inclusivity in a country where banking access is not universal.

2. Simplified Registration Process

Initiating the loan application is seamless, requiring users to fill out a straightforward application form with personal details and a confirmation number.

Verification is completed through an SMS code sent to the registered phone number, ensuring a secure and efficient registration process.

Essential eligibility criteria include being 20-60 years old, a Filipino citizen, having a stable income, and presenting a government-issued ID.

3. Tailored Credit Terms

Juanhand stands out by offering personalized credit terms based on the borrower’s solvency and credit rating.

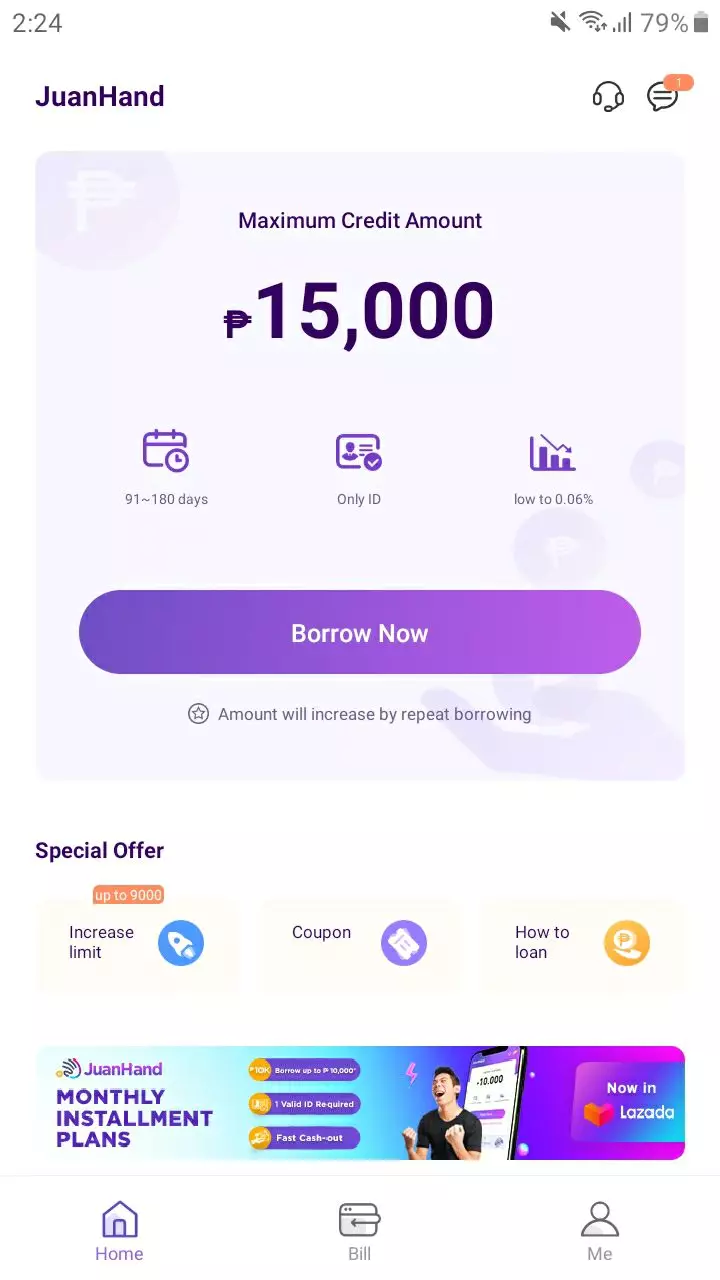

With flexibility ranging from PHP 2,000 to PHP 50,000 and interest rates between 9% to 15% per month, borrowers can access funds aligned with their financial capabilities, ensuring responsible lending practices.

4. Responsible Borrowing through Loan Calculator

Promoting responsible borrowing, Juanhand provides a user-friendly loan calculator.

This tool empowers borrowers to calculate monthly payments, uate interest rates, and make informed decisions, minimizing the risk of default and fostering a financially aware clientele.

5. Application Process

With a user-friendly mobile application, Juanhand simplifies the application process, allowing users to apply conveniently via mobile phone.

A credit limit of up to PHP 50,000, minimal requirements, and a swift approval timeframe of 5 minutes ensure accessibility for over 100 million users.

6. Loan Repayment Channels

Juanhand prioritizes customer convenience by offering multiple repayment channels, including Gcash, Coins.ph, 7-Eleven, RD Pawnshop, M. Lhuillier, Unionbank/InstaPay, and debit card payments through various banks. This diverse range ensures flexibility and accessibility in repaying loans.

7. Client Support in Financial Challenges

In cases of financial challenges or unpaid loans, Juanhand encourages immediate contact with customer support via email at Juanhand.

or the hotline 0998-3740-824. This proactive approach underscores the company’s commitment to assisting clients facing difficulties, aiming for mutually beneficial resolutions.

8. Product Features and Loan Example

Juanhand’s product features include a minimum financing amount of PHP 2,000, a maximum of up to PHP 15,000, and a loan term ranging from 30 to 90 days.

The daily interest rate falls between 0.3% to 0.5%, with an approval duration of up to 120 hours. Additionally, Juanhand supports debt consolidation, providing a holistic approach to financial management.

9. Example of Interest and Loan Payments

Through an illustrative example, Juanhand emphasizes the importance of understanding the cost implications and committing to timely repayments. This transparent approach empowers borrowers to make informed financial decisions, contributing to a positive borrowing experience.

Conclusion:

In conclusion, Juanhand emerges as a beacon of financial inclusion in the Philippines, offering accessible and legitimate online loans.

The commitment to transparency, automated processes, and swift approvals positions Juanhand as a valuable resource for individuals seeking financial assistance.

Operating under the FinVolution umbrella, Juanhand not only empowers borrowers but also contributes to charitable initiatives, showcasing a holistic approach to financial well-being.

Operating under the FinVolution umbrella, Juanhand not only empowers borrowers but also contributes to charitable initiatives, showcasing a holistic approach to financial well-being.

Author Maria Torres from Upfinance.

You can get a loan here: https://upfinance.com/loan-type/loan-online/