Hi, welcome to this article. Have you learned the difference between a Rollover Vs Transfer? If so, then I’ll say you’re in the right place.

The difference between rollovers and transfers is crucial for effective retirement fund management. Rollovers involve transferring funds from one retirement account to another, usually within the same account.

On the other hand, remittance is the direct transfer of funds between two financial institutions. The finer points are in the details, such as tax implications, eligibility criteria, and your control over your assets.

In this article, I have clarified these differences, empowering you to make decisions that align with your financial goals.

How to Execute a Rollover Vs Transfer?

To move your retirement money, start by talking to your bank. Know all the rules well. Work with both banks to switch your money without problems. Be careful with paperwork and deadlines to avoid delays. This guide helps you understand each step so you can do it.

Why Choose Rollover or Transfer?

Choosing between a rollover vs transfer hinges on aligning financial strategies with individual objectives. The decision is nuanced, involving investment flexibility, account consolidation, and access to diverse financial products.

Choosing to roll over your retirement savings might. Give you more control over your investments. Transferring funds could make it easier to manage your money across different institutions.

Knowing the benefits of each option helps you customize your choices to fit your needs. This ensures that how you manage. Your retirement savings match your unique financial situation and goals.

Rollover

1. Flexibility: Rollovers typically offer more flexibility regarding where you can move your funds. You can transfer funds from one retirement account to another of the same type (e.g., from one IRA to another IRA).

2. Consolidation: Rollovers can help consolidate multiple retirement accounts into one account, simplifying management and potentially reducing fees.

3. Access to Investments: Rollovers may provide access to a broader range of investment options, particularly if you move funds to a self-directed IRA or another account with broader investment choices.

4. Timing: Rollovers may allow you to control the timing of the transfer, which can be beneficial for tax planning purposes.

Transfer:

1. Directness: Transfers involve transferring funds directly from one financial institution to another without the funds passing through your hands. This can streamline the process and minimize the risk of tax consequences or penalties.

2. Simplicity: Transfers are often more straightforward than rollovers, as they involve less paperwork and administrative hassle.

3. Avoiding Taxes and Penalties: Transfers can help you avoid potential tax consequences and penalties associated with certain types of retirement accounts, particularly if you’re moving funds between similar accounts (e.g., transferring from one IRA to another IRA).

4. IRA-to-IRA Transfers: IRA-to-IRA transfers can be done as frequently as desired and are not subject to the once-per-year rollover rule, making them a preferred method for moving funds between IRAs.

Tips for Successful Retirement Fund Management

Achieving success in retirement fund management demands strategic planning and informed decision-making.

Here are key tips to enhance your approach:

- Diversify Your Investments: Spread your funds across various assets to mitigate risks.

- Monitor Fees: Regularly assess and minimize fees associated with your retirement accounts.

- Stay Informed of market trends, regulatory changes, and economic developments.

- Review Investment Options: Periodically update and adjust your investment portfolio for optimal performance.

- Reassess Strategy: Continuously reassess your financial strategy, considering changing goals and market conditions.

Types of Rollovers and Transfers

Exploring the diverse landscape of rollovers and transfers unveils several distinct types, each catering to specific financial needs and circumstances:

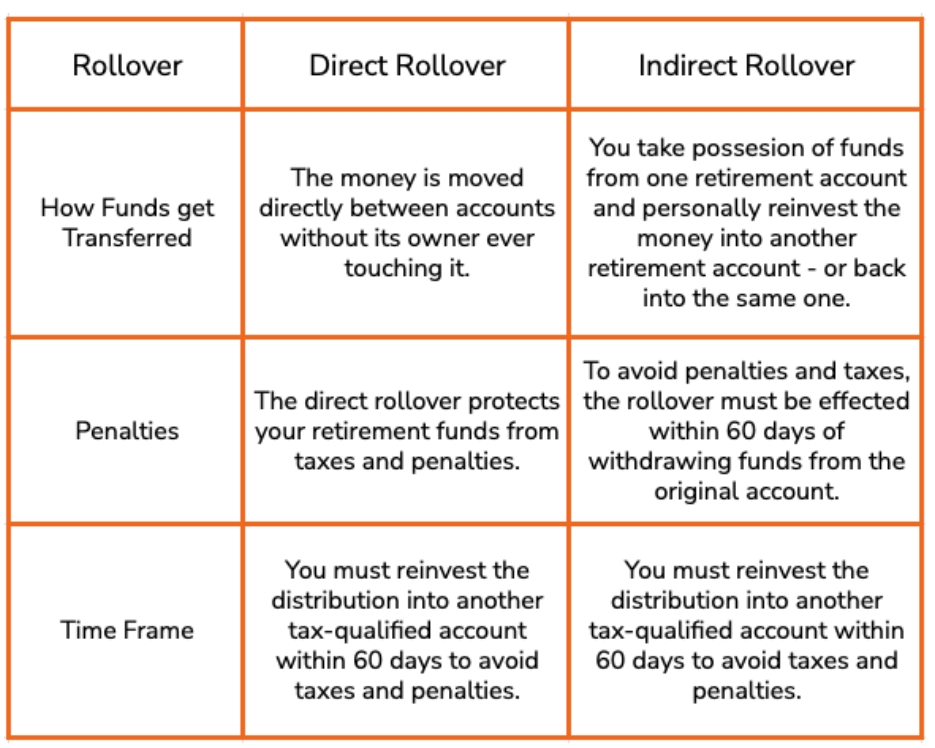

- Direct Rollover: A seamless transfer directly from one retirement account to another.

- Indirect Rollover: Involves receiving funds personally before depositing them into another account within 60 days.

- Trustee-to-Trustee Transfer: A direct movement of funds between financial institutions, eliminating the need for account holders to handle the funds.

- IRA-to-401(k) Transfer: Shifting funds between these two types of retirement accounts, often influenced by employment changes.

Common Pitfalls to Avoid

Moving money from one retirement account to another requires paying close. Attention to potential problems. These can include making tax mistakes, administrative errors, or waiting too long. People need to be careful to avoid these issues.

Other problems that can mess up moving retirement money are not planning the timing well, not doing enough research, and forgetting about who can actually do the transfer.

This part of the guide is essential. It discusses these possible problems and helps people know how to avoid them so they can manage their money well.

Comparing Tax Implications

Deciding what to do with your retirement money involves thinking about taxes. This part looks at how taxes affect your choices. It considers things like fines, timing, and possible benefits.

Knowing about taxes helps you make intelligent decisions that match your money goals. It enables you to pay fewer taxes and get the most out of how you manage your retirement money.

Ensuring Compliance with Regulations

It’s important to follow the rules when moving your retirement money around. Following the laws and standards keeps you safe from problems and fines.

It means keeping up with tax rules, how much you can put in, and when you can move money. By following all the rules, you can ensure your money moves, which makes you feel sure about managing your retirement savings.

This promise to follow the rules gives you a strong base for managing your money in the complicated world of finance.

Conclusion

When managing your retirement money well, it’s important to understand the differences between Rollover and Transfer. This guide helps you learn about taxes, common mistakes, and how to choose between them.

To build a secure future, you can make a strong financial plan, follow rules, and learn from real examples.

With this knowledge, you’ll be ready to make intelligent choices. Make the most of your retirement money, and enjoy life after work.