In today’s fast-paced world, convenience and efficiency are paramount, even when it comes to managing your finances. BMO Harris understands this need and has introduced an innovative solution called BMO Harris Express Loan Pay. This streamlined allows you to effortlessly make loan repayments, saving you time and effort.

In this article, we will explore the features and benefits of BMO Harris Express Loan Pay, highlighting how it can simplify your loan repayment process.

What is BMO Harris Express Loan Pay?

It is your ticket to a hassle-free loan payment experience. It’s a nifty online platform BMO Harris provides that lets you breeze through settling your loans. Picture this as your virtual assistant for making payments – a quick and secure way to manage your finances. Whether it’s your mortgage, auto loan, or personal loan, it has covered you.

No need to fret about extra fees; BMO Harris has your back. And here’s the cherry on top – you can even schedule future payments, putting you in control. Worried about security? Don’t be – BMO Harris prioritizes keeping your financial info safe.

So, if you want a seamless way to handle your loan payments, it is the friend you’ve been looking for.

Read more: TraceLoans – Revolutionizing Loan Management and Clarity

Is BMO Harris Express Loan Pay secure?

In the digital age, security is paramount and a testament to safeguarding your financial transactions.

Here’s why you can trust the security measures in place:

- Encryption Protocols: This employs robust encryption protocols to shield your sensitive information. This ensures that your data is transmitted securely over the internet, protecting it from unauthorized access.

- Secure Login: The platform prioritizes secure access. When logging in to BMO Harris Express Loan Pay, users utilize their BMO Harris Online Banking credentials, adding an extra layer of protection through established and trusted login procedures.

- Transaction Security: Every payment transaction made through it undergoes stringent security checks. This minimizes the risk of fraudulent activities, assuring users that their financial transactions are closely monitored and validated.

- Ongoing Monitoring: BMO Harris continuously monitors the security landscape to stay ahead of potential threats. This proactive approach ensures that security measures evolve to counter emerging risks, providing users a secure environment for their financial transactions.

- Customer Support: In the rare event of concerns or issues. BMO Harris offers dedicated customer support. This ensures that users can promptly address any security-related queries. Enhancing their confidence in using BMO Harris Express.

BMO Harris Express Loan Pay doesn’t just simplify loan payments. It does so with a steadfast commitment to security.

The combination of encryption, secure login procedures, transaction monitoring, and responsive customer support is established. It is a reliable and secure platform for managing your financial obligations.

The Benefits of BMO Harris Express Loan Pay

BMO Harris Express Loan Pay offers a range of advantages, making loan management seamless and efficient for users.

Here are the key benefits:

- Convenience: It provides a convenient way for customers to manage their loan payments. It offers a streamlined process that allows borrowers to make payments quickly and easily, saving them time and effort.

- Speedy Transactions: With Loan Pay, borrowers can make payments and have them apply to their loans immediately. This ensures that their accounts are up to date and helps them avoid any potential late fees or penalties.

- Flexibility: The platform offers various payment options, allowing borrowers to choose the best method. Whether making payments online, through mobile banking, or setting up automatic payments, They offer flexibility to accommodate individual preferences.

- Enhanced Security: It prioritizes the security of customers’ financial information. It utilizes advanced encryption and authentication protocols to ensure that transactions are secure and private.

- Accessible 24/7: It is available 24/7, providing borrowers with the convenience of making payments at any time. This accessibility ensures that customers have full control over their loan payments.

How to Use BMO Harris Express Loan Pay?

It is a convenient tool that allows customers to manage their loan payments quickly and easily.

Here are some steps to guide you on how to use BMO Harris Express Loan Pay:

- Visit the BMO Harris website or download the mobile app. Reference: BMO Harris Bank. (n.d.). Loan Pay. Retrieved from

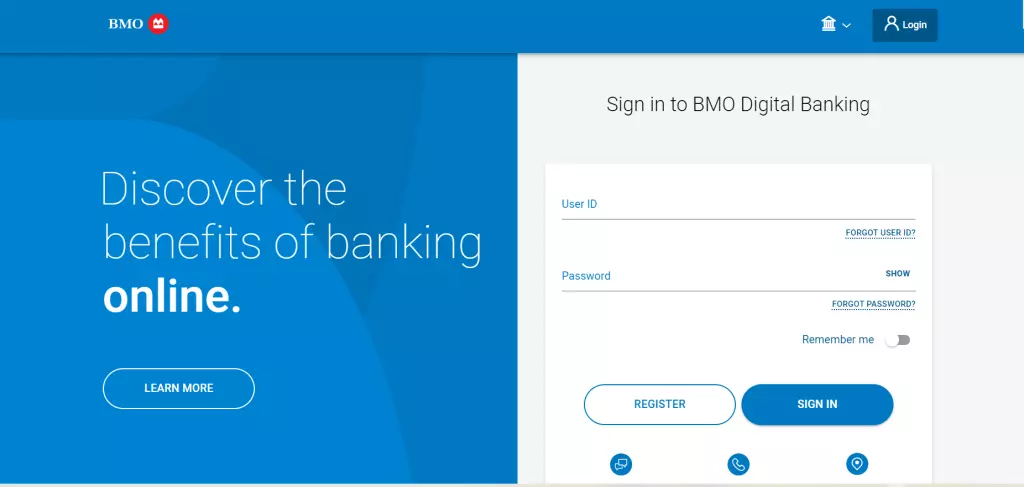

- Log in to your BMO Harris account using your credentials.

- Navigate to the Loan Pay section within your account dashboard.

- Select the loan you want to make a payment for from the available options.

- Enter the payment amount and choose the account from which you want to make the payment.

- Review the payment details and click on the “Submit” button to proceed.

- Confirm the payment by reviewing the summary provided.

- Once the payment is processed successfully, you will receive a confirmation message.

- Keep track of your payment history and account balance using the Loan Pay feature.

Using it streamlines the loan payment process, saving you time and offering a convenient way to manage your loan obligations. Make sure to refer to the official BMO Harris Bank website for specific instructions and updates on the Loan Pay feature.

What types of loans can I pay using this service?

BMO Harris Express Loan Pay caters to diverse loans, providing users with flexibility and convenience.

Here’s a breakdown of the types of loans you can seamlessly manage and pay using this service:

- Mortgages: Whether it’s your primary residence or an investment property. It accommodates mortgage payments, ensuring the hassle-free settlement of this significant financial commitment.

- Auto Loans: With BMO Harris Express, managing your car loan becomes a breeze. Stay on top of your auto loan payments and maintain the financial health of your vehicle.

- Personal Loans: BMO Harris understands the varied needs of its customers. And Express Loan Pay reflects this by allowing users to pay off personal loans conveniently. From unexpected expenses to planned investments, this service covers it all.

- Home Equity Loans: Utilize the convenience of BMO Harris Express to handle your home equity loan payments effortlessly. Stay in control of your financial commitments related to home equity.

- Student Loans: BMO Harris Express seamlessly manages education expenses. Stay on track with your student loan payments and focus on your educational journey.

- Business Loans: For entrepreneurs and business owners. It extends its reach to cover business loan payments. Easily manage and settle your business-related financial obligations.

- Credit Card Balances: It allows users to make payments towards credit card balances, providing a comprehensive solution for managing various financial aspects.

The versatility of BMO Harris Express makes it a one-stop platform for handling various loans. This comprehensive approach underscores BMO Harris’s commitment to providing users a convenient and efficient tool for managing their diverse financial commitments.

Step-by-Step Guide: Making Loan Payments with BMO Harris Express Loan Pay

To make loan payments with BMO Harris Express Loan Pay, log in to your BMO Harris Online Banking account, locate the loan payment section, choose your loan account, select a payment method, enter payment details, review and confirm the transaction, submit the payment, explore additional features if desired, and securely log out after completion.

Here are some steps to guide you on how to use BMO Harris Express Loan Pay:

- Visit the BMO Harris website: Go to the official BMO Harris website using your preferred web browser (reference: www.bmoharris.com).

- Log in to your account: Use your login credentials to access your BMO Harris online banking account. If you don’t have an account, you can easily create one by following the registration process provided on the website.

- Locate the “Payments” section: Navigate to your online banking dashboard’s “Payments” section.

- Select “Express Loan Pay”: Within the “Payments” section, look for the option called “Express Loan Pay” and click on it.

- Choose your loan account: Select the loan account towards which you wish to pay from the available options.

- Enter payment details: Provide the required payment information, including the amount you want to pay and the source of funds (e.g., checking account).

- Confirm and submit payment: Double-check the payment details for accuracy, then click on the “Submit” button to finalize your loan payment.

- Verify payment confirmation: After submitting the payment, you should receive a confirmation message indicating your payment has been successfully processed.

To conveniently repay loans through a legal money lender, adhere to these step-by-step guidelines, utilizing BMO Harris Express Loan Pay. This will ensure your payments are handled securely and conveniently.

Features and Functions of BMO Harris Express Loan Pay

- Quick and Convenient: They offer a fast and hassle-free way to repay loans. Customers can easily submit their payments online with just a few clicks, saving time and effort.

- Secure Payment Processing: The platform ensures the security of customers’ personal and financial information during the payment process. It utilizes advanced encryption technology to protect sensitive data from unauthorized access.

- Multiple Payment Options: It provides customers with various payment options. Users can make payments directly from their BMO Harris Bank account, set up recurring payments, or use external bank accounts.

- Real-Time Payment Updates: Customers receive instant confirmation of their payment transactions through Loan Pay. This feature allows users to stay updated with their loan payment history and ensures transparency in the payment process.

- 24/7 Accessibility: The platform offers round-the-clock accessibility, allowing customers to make loan payments conveniently. Whether it’s day or night, it is available for use.

Exploring the Convenience of BMO Harris Express Loan Pay

BMO Harris Express streamlines the loan payment process, offering users a hassle-free and efficient experience. With its user-friendly interface, diverse payment methods, and the ability to schedule future payments.

It ensures convenient loan management. Discover the ease of settling loans anytime, anywhere, enhancing your financial control and peace of mind.

- Quick and Hassle-Free: It provides borrowers with a convenient and streamlined process for loan repayments. With just a few clicks, customers can easily pay online, saving time and effort.

- Accessibility: This service allows borrowers to make payments from anywhere, anytime. Whether they’re at home, in the office, or on the go, customers can access their loan accounts and initiate payments through the BMO Harris Express platform.

- Secure and Reliable: BMO Harris Bank prioritizes securing its customers’ financial information. The Express Loan Pay employs advanced encryption and security measures to protect transactions and keep personal data confidential.

- Enhanced Tracking and Management: Through BMO Harris Express, borrowers can access a comprehensive overview of their loan repayment history. They can easily track their payments, view statements, and manage their accounts, providing greater control over their financial obligations.

- Time and Cost Savings: Express Loan Pay allows customers to avoid visiting physical branches or mailing checks for loan repayments. This saves time and eliminates postage costs, making the repayment process more efficient and cost-effective.

Maximizing Efficiency with BMO Harris Express Loan Pay

It is a powerful tool for optimizing the efficiency of your loan management. With a straightforward interface, diverse payment options, and the ability to schedule future payments. This platform ensures a streamlined and convenient experience.

Take control of your financial obligations with the efficiency and flexibility BMO Harris Express Loan Pay offers.

- Convenient and Fast Application Process: Loan Pay offers a streamlined application process, allowing borrowers to apply online quickly and conveniently. This eliminates the need for lengthy paperwork and reduces the time required for loan approval.

- Instant Decisioning: With

- Loan Pay, borrowers receive instant decisions on their loan applications, minimizing waiting time and providing immediate access to funds. This feature is especially beneficial for individuals who require urgent financial assistance.

- Simplified Payment Options: It provides borrowers with flexible payment options, enabling them to choose a repayment plan that aligns with their financial capabilities. This ensures ease and convenience in managing loan repayments.

- Efficient Fund Disbursement: Once approved, funds are disbursed swiftly through Loan Pay. This enables borrowers to receive the funds they need promptly, eliminating delays and allowing them to address their financial needs promptly.

- Competitive Interest Rates: Loan Pay offers competitive interest rates, ensuring borrowers can access funds at affordable rates. This makes it an attractive option for individuals seeking efficient financing solutions.

By leveraging the features provided by BMO Harris Express Loan Pay. Borrowers can maximize their efficiency in obtaining funds and managing loan repayments.

Read more: Wizzay Money.

Security and Safety Measures of BMO Harris Express Loan Pay

It prioritizes the security of your financial transactions. Employing robust encryption protocols, secure login procedures, and continuous monitoring. The platform guarantees the safety of your sensitive information.

Explore the benefits of secure transactions with BMO Harris Express Loan Pay, providing peace of mind for users.

- Encryption: BMO Harris Express Loan Pay utilizes robust encryption protocols to secure all sensitive customer information during transmission. This ensures that data, such as personal details and financial transactions, are protected from unauthorized access.

- Secure Login: The platform requires users to use a multi-factor authentication process to access their accounts. This includes a combination of passwords, security questions, and one-time verification codes, enhancing the overall security of the login process.

- Fraud Monitoring: BMO Harris employs advanced detection s to monitor transactions and identify suspicious or fraudulent activities. This proactive approach helps to prevent unauthorized access and protects customers from potential financial loss.

- Firewalls and Intrusion Detection Systems: The is fortified with firewalls and intrusion detection s that constantly monitor network traffic, identify potential threats, and block unauthorized access attempts.

- Regular Security Audits: BMO Harris conducts regular security audits and assessments to identify any vulnerabilities in the . This enables them to promptly implement security patches and updates, ensuring the platform’s ongoing security.

- Compliance with Industry Standards: It adheres to industry standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), to maintain the highest level of data security and protect customer information.

Enhancing Your Loan Management with BMO Harris Express Loan Pay

BMO Harris Express Loan Pay elevates your loan management experience with its user-friendly features. From swift payments and accessibility to diverse payment methods, the platform enhances convenience.

Explore the efficiency of BMO Harris Express Loan Pay, which makes managing your loans seamless and stress-free.

- Streamline loan repayments: BMO Harris Express Loan Pay provides a seamless and efficient way to manage your loan repayments. This innovative platform allows you to make payments online, saving time and effort.

- Convenience at your fingertips: You can access your loan account anytime, anywhere. Whether on your computer or using the mobile app, you can quickly view your loan details, make payments, and track your repayment progress.

- Faster processing: Say goodbye to long processing times. It expedites the payment process, promptly applying your payments to your loan account. This helps you stay on top of your loan obligations and avoid late fees.

- Secure and reliable: BMO Harris prioritizes the security of your financial information. Express Loan Pay employs advanced encryption and authentication measures to safeguard your personal and banking details.

- Efficient reporting: The platform offers comprehensive reporting features, allowing you to generate payment history and statements easily. This helps you stay organized and track your loan repayment journey accurately.

By leveraging it, you can take control of your loan management, simplify the repayment process, and achieve your financial goals more effectively.

BMO Harris Express Loan Pay: Streamlining the Loan Repayment Process

It is an innovative solution that aims to streamline the loan repayment process. With this convenient service, borrowers can experience a hassle-free and efficient way to repay their loans.

Here are some key features and benefits of BMO Harris Express Loan Pay:

- Online Platform: BMO Harris provides borrowers with a user-friendly online platform where they can securely access their loan account and make payments anytime, anywhere.

- Fast and Efficient: The Express Loan Pay service ensures quick processing of loan payments, reducing the time and effort required to complete the repayment process.

- Automated Payments: Borrowers can set up automatic recurring payments, eliminating the need to initiate each payment manually. This feature helps borrowers stay on track and avoid late payment fees.

- Enhanced Security: BMO Harris prioritizes the security of customer information and transactions, employing robust encryption measures to safeguard sensitive data.

It aims to provide borrowers with a seamless and efficient loan repayment experience. With its online platform, fast processing, automated payments.

Enhanced security, borrowers can enjoy a simplified and convenient way to manage their loan repayments.

Frequently Asked Questions For BMO Harris Express Loan Pay

A1: It is an online platform designed to facilitate convenient and efficient loan payments. It streamlines the process, making it easier for users to manage various types of loans.

A2: BMO Harris Express Loan Pay accommodates various loans, including mortgages, auto loans, personal loans, home equity loans, student loans, business loans, and credit card balances. This flexibility allows users to settle various financial obligations conveniently in one centralized platform.

A3: To access the service, visit the official BMO Harris Express Loan Pay website. Log in using your BMO Harris Online Banking credentials to ensure a secure and personalized experience.

A4: It generally does not charge fees for using Express Loan Pay. However, users are encouraged to review their loan agreements for any potential fees associated with particular payment methods.

A5: It allows users to schedule future loan payments, providing flexibility and ensuring timely payments without manual intervention.

A6: Security is a top priority. BMO Harris employs advanced encryption protocols and secure login procedures to safeguard user information. Ensuring a secure environment for financial transactions.

A7: In case of issues or questions, BMO Harris offers dedicated customer support. Users can reach out for assistance, ensuring a reliable and smooth experience with BMO Harris Express Loan Pay.

BMO Harris Express Loan Pay is a user-friendly platform that caters to various loan types. Emphasizing flexibility, security, and customer convenience in managing financial commitments.