Auto Finance Strategies for Entrepreneurs The auto finance industry is undergoing rapid transformation. Emerging digital technologies and evolving customer demands drive this change. This dynamic landscape presents significant opportunities for entrepreneurial growth and diversification.

Entrepreneurs can unlock the full potential of the multi-billion-dollar auto finance sector by harnessing innovative technologies.

They can also optimize operations and forge strong customer relationships. It will help them secure business auto loans and be successful.

Advanced Digital Technologies Reshaping Auto Finance

New digital technologies are changing how entrepreneurs in the car business get money. They use intelligent computers, special programs, and online systems. These tools help entrepreneurs get loans faster, find the right loan, and see their money situation in real time.

These digital platforms offer more ways to get money, like bank loans or borrowing from others. This gives entrepreneurs more options to grow their car businesses. These digital tools make money transactions safer and more accessible, which helps build trust.

These new digital technologies are making car finance easier for entrepreneurs. By using them, entrepreneurs can better manage their money and explore new opportunities in the car industry.

1. Automation

Automation Auto Finance for Entrepreneurs helps car business owners a lot. It uses advanced technology to make things faster and easier.

- This program aids car industry entrepreneurs by providing automatic tools for loan acquisition, payment tracking, and customer management.

- Using this technology, entrepreneurs can save time and make fewer mistakes. It helps them make decisions quickly and treat customers better.

- The automatic systems can examine money information, determine whether someone can pay, and suggest the best loan options.

This system helps business owners concentrate on essential tasks while computers care for the dull money. So, they can do more, spend less, and outperform their rivals.

2. Data Analytics

Boise Auto Finance uses brilliant computer analysis to help car industry business owners make better financial decisions. They study a lot of data about how customers purchase cars, what’s popular, and how to manage risks.

By looking at all this information, they can determine how to make more money, avoid problems, and keep customers happy.

People at Boise Auto Finance use data analytics to find patterns and trends in how people pay for cars. This helps them plan better for the future and ensure they do things correctly.

They also use advanced computer programs to predict whether someone will repay a loan and create personalized offers for customers.

3. Online Platforms

Online platforms make it easy for business owners to get money to buy vehicles. You can apply for a loan quickly and easily from home or work using the internet.

These platforms offer fair rates and flexible repayment options. They understand entrepreneurs need a reliable way to get around for their businesses.

Some platforms even have unique options for businesses that are just starting or need a specific type of vehicle.

With these platforms, entrepreneurs can get the money they need quickly, allowing them to focus on growing their businesses without dealing with complicated loan processes.

These online platforms help entrepreneurs get money quickly and flexibly to buy vehicles for their businesses.

Innovative Business Models Transforming Auto Finance

Entrepreneurs who like to plan for the future are trying out and using new ways to finance cars. They’re doing this to stand out in a market where many others are competing..

1. Point-of-Sale Financing

Entrepreneurs who need vehicles for their businesses can consider point-of-sale financing, especially for buying cars.

This type of financing allows them to get the money they need right when they’re ready to purchase a vehicle.

Car dealerships often partner with banks or lenders to offer this option, making it easier for entrepreneurs to purchase a vehicle without the usual loan or lease hassles.

With point-of-sale financing, entrepreneurs can choose payment options and interest rates that suit their financial and business needs. This simplifies the vehicle-buying process, allowing entrepreneurs to focus on growing their businesses.

This financing helps entrepreneurs keep their money available for other important business expenses. They can still acquire the necessary vehicles to keep operations running smoothly.

Overall, it’s a convenient and tailored way for entrepreneurs to obtain the cars they need for business growth.

2. Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms are like helpers for folks who want money to buy a car for their business. These platforms link those who need money with people ready to lend it.

Entrepreneurs can use these platforms to borrow money for a car instead of going to a bank. Doing this is often faster and might have lower interest rates than using a bank.

It’s also usually easier to get a loan on these platforms, even if someone doesn’t have a great credit history or much to offer as a guarantee. This lets more people start or expand their car-related businesses.

3. Car Subscriptions

Subscriptions for short-term access to cars provide flexible solutions without long-term commitments. Millennials are taking a keen interest.

Business Model Comparison

New ways of doing car money stuff are changing. If you do the right things, business owners can make more money in different ways with these new ways.

| Model | Investment | Risk Profile | Scalability |

| Point-of-Sale Financing | High | Low | High |

| Peer-to-Peer Lending | Low | High | Moderate |

| Car Subscriptions | Moderate | Moderate | High |

Optimizing Lead Generation

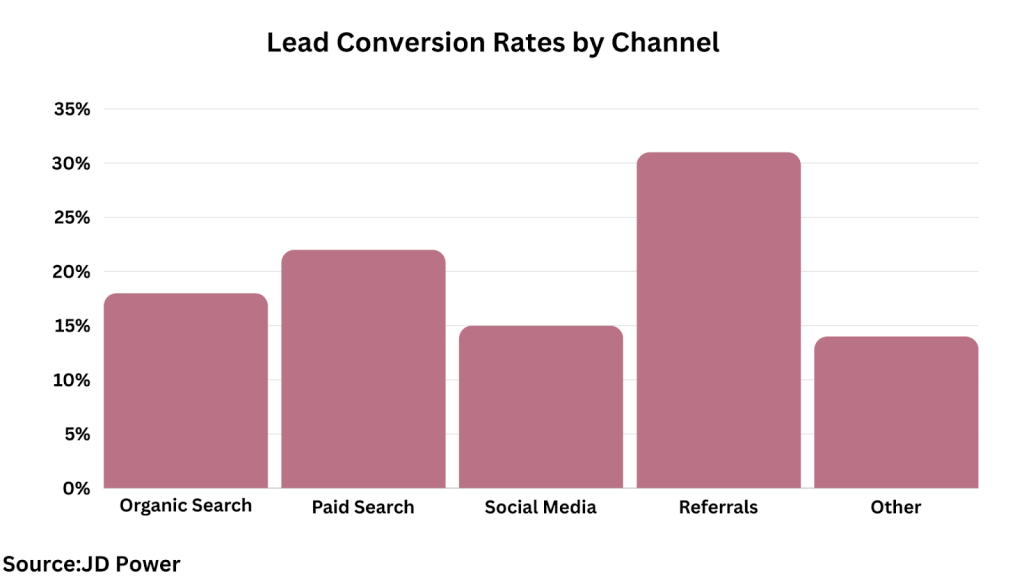

Entrepreneurs need robust plans to find people interested in getting car loans. The aim is to find those who want car loans and then convince them to get loans. Now, let’s check out some of these plans.

- Digital Marketing: Use SEO, social ads, and email campaigns to keep your brand visible. Reach out to potential customers with personalized messages.

- Strategic Partnerships: Co-marketing with auto dealers and related platforms to broaden your audience. Offer complementary services to their existing customers.

- Referral Programs: Encourage loyal customers to refer others with promotions. Referrals tend to convert 30% better than other leads.

Entrepreneurs can keep a soundtrack of where potential customers are coming from and how good they are. They can do this by using marketing tools. Making these strategies better all the time can make more people become customers in the long run.

Securing Business Auto Loans

For entrepreneurs, financing business vehicles or assets is key to smooth operations. Here are other things to consider when securing business auto loans.

1. Vehicle and Budget Analysis

Before getting a loan, business owners should consider what vehicles they need. This means examining things like what kinds of vehicles they need, how much they cost, and whether they’re dependable. Business owners can better decide what vehicles to get by understanding these things.

It’s crucial to figure out how much money you can spend on getting these vehicles. Pick a loan amount that’s a little extra, just in case. This way, business owners can earn extra money if something unexpected comes up.

2. Lender Comparison

Many lenders offer good car loans. Business owners should consider all the options to find the best one for them.

Business owners can compare many lenders to find the one with the best terms. This can save money and provide better loan terms, which is good for the business in the long run.

3. Loan Application

Once entrepreneurs find a good lender, they must complete a detailed loan application. They need to collect various papers, such as their business finances, predictions about cash flow, and a thorough business plan.

These papers give lenders essential details about the company. They show how well the business is doing financially, if it can repay the loan, and if it’s a good idea overall.

Entrepreneurs investigate different choices, make plans, and build strong relationships with lenders over time, which makes it easier for them to get loans when they need them to grow.

Building Customer Loyalty

Nurturing strong customer relationships is crucial for achieving profitability by:

- Personalization: Use data to understand micro-segments and curate personalized recommendations on financing options.

- Omnichannel Presence: Make it easy for customers to engage with your brand when and where needed—branch, app, web, phone.

- Transparency: Communicate clearly on interest rates, fees, and repayment terms. Be transparent in dealing with customer grievances.

Entrepreneurs can enhance loyalty, lifetime value, and business growth by focusing on trust and convenience.

The Future is Digital

Consumer tastes and technology change over time. Entrepreneurs must be flexible and able to adjust.

If you’re an entrepreneur, put money into digital skills. These will help you make decisions based on information. Try new ideas like P2P lending. Make sure everything you do focuses on what your customers want.

For car financing to succeed in the future, entrepreneurs must be quick to adapt to customers’ needs and come up with new ideas.

Conclusion

The auto finance industry has many chances for people wanting to start their own businesses. If you’re an entrepreneur, you can do well in this changing field.

You can use new digital tools and smart business ideas. This way, you can find new customers, get loans for their businesses, and make sure customers keep coming back.

To do well, entrepreneurs need to stay flexible and open to change. They should always consider what their customers want to do well in this changing industry. This will also help them find new chances to grow in auto finance later.

FAQs

- What are the emerging auto finance business models suitable for startups?

Point-of-sale financing has low barriers to entry and quick scalability. P2P lending offers lean operations but needs sharp digital marketing skills.

- How can technology help improve lead conversions?

It helps by tracking lead behaviour through analytics tools. It optimizes campaigns for higher conversion rates over time. Automated workflows also help process promising leads faster.

- What are some proven customer retention strategies?

Hyperpersonalization leads to higher retention and growth. This happens through segmentation, omnichannel services, transparent communication, and resolving complaints quickly.