Cancer has a notorious track record of taking lives like only a few other health conditions have. Protecting yourself with a health insurance policy has become an inevitable course of life due to such illnesses.

With the insurance industry evolving, we have policies that pertain to the treatments and payments of patients diagnosed with cancer. With some research and understanding, you can find the best health insurance for cancer patients.

Since cancer is an overriding concern, making informed decisions while choosing cancer health insurance becomes paramount. In this blog, we learn more about cancer insurance and discuss things you must know before you buy a policy.

Understanding Cancer Insurance

A health policy that offers financial coverage and assistance for different types of cancer is called cancer insurance. A person pays periodic premiums in order to receive financial coverage whenever they need it. The policyholder will receive a lump-sum amount or reimbursement when they raise a claim for their treatment.

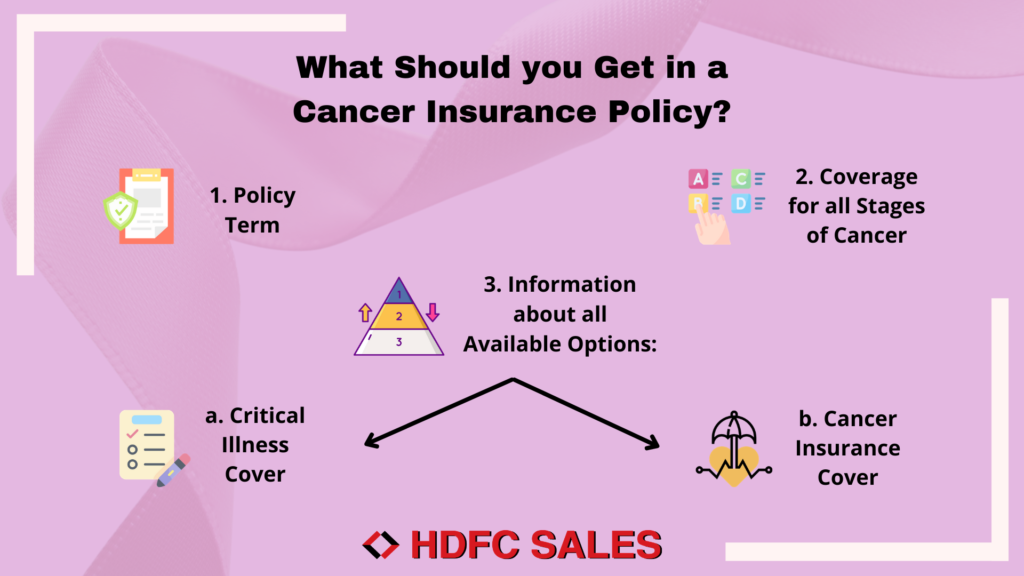

You are offered customisable plans that provide comprehensive coverage for yourself and your loved ones. However, in order to enjoy these benefits and coverage, you will have to choose the best cancer insurance in the market. Here are a few factors to consider when making a good decision.

Things You Should Know Before You Buy Cancer Insurance

● Cancer Policy Coverage

If you want extensive financial provisions, your policy must offer a vast spectrum of features and benefits, like cashless hospitalisation, chemotherapy, top-notch quality treatment, international hospital coverage or much more. The inclusions of the policy must include a wide range of possibilities and conditions.

● Inclusions and Exclusions

As mentioned above, ensure that your preferred policy has a wide range of inclusions. The policy must cover the initial expenses when the condition is diagnosed with pathology and supported by medical evidence. Also, health insurance must provide common medical costs like nursing and hospitalisation.

Assess the exclusions of your policy. These elements refer to the conditions when the policy will not cover your expenses. Exclusions for cancer insurance usually consist of treatment not related to the insured condition, sexually transmitted diseases and pre-existing conditions at the time of issuing the policy.

● Eligibility Criteria

Check the criteria for being eligible to buy this health policy. If you do not fit the rules and regulations of the policy, you cannot buy one. For instance, most cancer policies have eligibility regulations that say that they need evidence of health checkups, specific age, maturity age and should not have cancer as a pre-existing illness.

● Survival and Waiting Period

Survival period refers to the amount of time period the policyholder has to survive after the diagnosis in order for the coverage to activate. If the policyholder surpasses those many days, they receive the rightful amount of coverage for their future treatments. However, if they do not survive, they cannot claim the coverage.

Waiting period refers to the amount of time/days the policyholder has to wait in order to raise a claim. Usually, this period ranges from a few months to a year. This period is designed as a safety guard for the insurance company to secure itself from fake claims.

If you want to raise and receive your rightful claim, you need to be aware of these two terms and concepts.

● Policy Premiums and Affordability

Choosing a health policy with affordable cancer insurance costs is completely in your hands. Since cancer treatments and medicines are expensive, you need to find low-premium, highly efficient cancer insurance. So, look for maximised protection in affordable cancer insurance costs.

● Claim Settlement Ratio

Let us say you have a policy provider in your preferences. After assessing the above factors, ensure that the claim settlement ratio is checked. Claim settlement ratio refers to the percentage of policyholders who got their claims approved as compared to the percentage of policyholders who raised a claim for the same.

This ratio will offer you an insight into the insurance company’s ethicality and financial health. Some reputed companies in the market have a high claim settlement ratio. For example, Tata AIG has a claim settlement ratio of 96.70% for health insurance claims.

● Renewal Terms and Charges

Renewal terms and conditions are not easy to navigate. Many companies try to trick into paying more renewal charges than the market value by adding different elements. So, when you choose to buy cancer insurance, read the renewal terms and their charges for safety matters.

Conclusive Thoughts

Diagnosis, prescribed medicines, chemotherapies and other treatments are a nightmare to the person who pays for them. But not anymore. Buy cancer insurance that protects you and your family throughout the process of getting better.

Ensure that you follow all the above suggestions to buy the best policy you can and protect your finances.